Is a Major Disadvantage of the Corporate Form of Business

There are certain minor disadvantages of the corporate form which may in some cases be of sufficient importance to prevent the adoption of this form. Cooperatives are more relaxed in terms of structure so members who dont fully participate or contribute to the business leave others at a disadvantage and risk turning other members away.

Types Of Business Loans Bond Market Business Loans Accounting Student

Corporations must maintain proper accounting records for transparency.

. Unlimited liability Double taxation Transfer of ownership Lack of ability to raise capital. Some disadvantages of corporation are the corporate income is taxed two times and the creation and design of the company will require protocols. Depending on the type of corporation it may pay taxes on its income after which shareholders pay taxes on any dividends received so income can be taxed twice.

The primary disadvantage of the corporate form is the double taxation to shareholders of distributed earnings and dividends. The primary disadvantage of the corporate form is the double taxation to shareholders of distributed earnings and dividends. The first and most important is simply the obverse of the advantage of limited liability for the shareholders.

Depending on the type of corporation it may pay taxes on its income after which shareholders pay taxes on any dividends received so income can be taxed twice. One disadvantage of corporations is the double taxation of income to the owners. A major disadvantage to the corporate form of business is D.

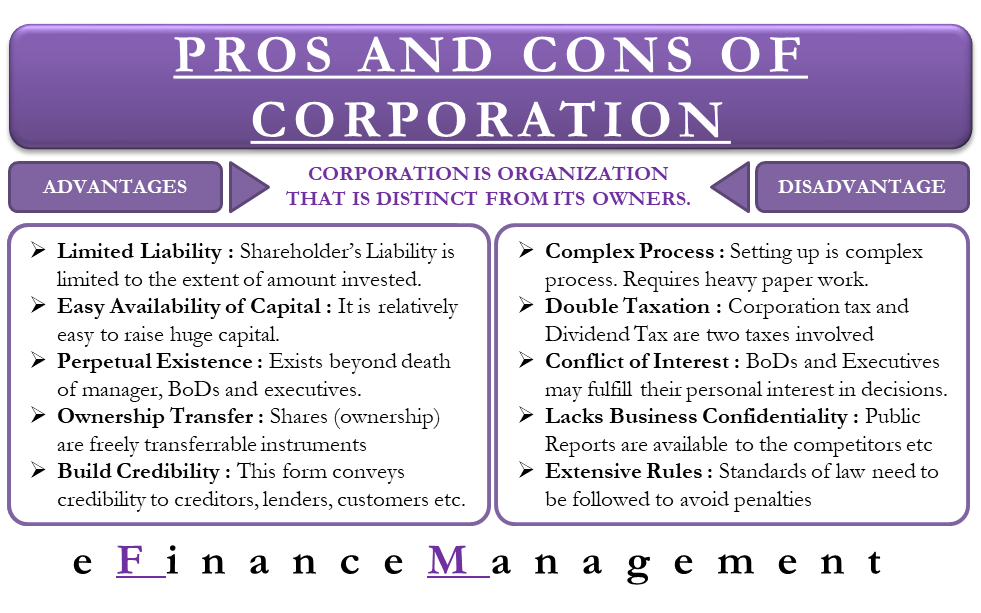

Disadvantages Of The Corporate Form. Corporations offer a business many advantages but there are also disadvantages that must be considered. Is a major disadvantage of the corporate form of business.

Finance questions and answers. The relationship between the owner of a corporate security and the business itself being purely impersonal the securities which represent ownership may be freely transferred. The primary disadvantage of the corporate form is the double taxation to shareholders of distributed earnings and dividends.

The disadvantages of a corporation are as follows. Many cooperatives exist in the retail service production and housing industries. Government agencies tend to monitor corporations which could mean more paperwork.

Asked Aug 9 2019 in Economics by Michelle5060. Limited liability ease of transfer-ability ability to. What is a disadvantage of the corporate form of organization.

These include loss of control of the business as it moves from privately owned to publicly owned. Double taxation is a disadvantage of a corporation because the corporation has to pay. The owner pays taxes on all the income ANS.

State-required filing fees written bylaws and various documents. C Lack of ability to raise capital. Learn more about the corporate form of organization and its examples the advantages and.

3 corporation is a separate legal entity created by state law - taxed as a separate legal entity - any income that is dispersed to the owners and shareholders is also taxed - result is a major disadvantage of the corporate form - double taxation 4 major advantage of corporate form is limited liability for the owners. Two key advantages of the corporate form over other forms of business organization are unlimited liability and limited life. Question 4 of 20 50 50 Points __________ is a major disadvantage of the corporate form of business.

Limited Liability Company is a business that takes the advantages of both partnership and corporation together making a new form of business. Its life and existence is separate from the lives of its individual owners and managers. What are the Disadvantages of a Corporation.

D Transfer of ownership. A major disadvantage of a corporation is the double taxation of the corporations income and of dividends paid to shareholders. Corporations end up paying taxes twice.

A corporation is an organization that is considered as a single business separate entity from its owners. What is one major disadvantage of setting up a business as a corporation. Transcribed image text.

Depending on the kind of corporation the various types of income. And determination of and adherence to applicable. It is easy to finance growth d.

Is a major disadvantage of the corporate form of business. Secondly the corporation pays tax when it pays out dividends to its shareholders. It is expensive to establish b.

The corporation pays tax when it shows a profit. Limited liability ease of transfer-ability ability to raise capital and unlimited life. Sometimes this advantage involves placing a corresponding limitation on the.

A corporation is a legal entity that is generally created by a state. Double taxation if the business is a C corporation. Limited liability ease of transferability ability to raise capital unlimited life and so forth.

A major disadvantage of a sole proprietorship is the fact that a. The corporate form makes it possible to distribute ownership among any number of persons and thereby to raise very large amounts of capital. Creating a corporation is also more time consuming.

Lack of accountability. A disadvantage of the corporate form of business organization is that corporate income is taxed twice. QUESTION 1 The major disadvantage of the public corporation form of business organization is that it does not provide limited liability for owners incurs a double taxation of earnings when the firm pays dividends must be re-formed upon purchase by another firm is not a continuous business form QUESTION 2 A hostile takeover is discussed in.

The disadvantages of a corporation are as follows. Corporations acquire investments from various shareholders and for that reason the law tries to protect those shareholders by forcing corporations to go through several legal requirements such as. See Page 1.

The owner has unlimited personal liability c. Creating a corporation is more expensive than any other type of business. The fourth and final major form of businesses organization is limited liability company LLC.

Lack of ability to raise capital D.

Chapter 4 Forms Of Business Ownership Introduction To Business

Pin By Silverberg Omer On O5r Megadungeon D D Dungeons And Dragons Dungeons And Dragons 5 Dnd Monsters

Do You Know The Things About Python Tccicomputercoaching Com Python Programming Programming Languages Object Oriented Programming

Dnd5e Homebrew Paladin Oath Dnd Paladin Dungeons And Dragons Homebrew Dungeons And Dragons Classes

Advantages And Disadvantages Of Corporations

Operating Profit Vs Net Profit Top 7 Best Differences With Infographics Net Profit Project Finance Financial Modeling

What Is A Company Definition Characteristics Advantages Disadvantages

Chapter 4 Forms Of Business Ownership Introduction To Business

Necromancers Monstrosity Dungeons And Dragons Homebrew Dungeons And Dragons 5e Dnd Monsters

Free Form Organization Five Disadvantages Of Free Form Organization And How You Can Workarou Power Of Attorney Form Tree Graphic Organization

Advantages And Disadvantages Of The Corporate Form Of Business

Being A Brand Digital Marketing Agency Digital Marketing Public Relations

All Of The Disadvantages In This World Stems From A Person S Lack Of Ability Rize Tokyo Ghoul Tokyo Ghoul Tokyo Ghoul

Advantages And Disadvantages Of The Corporate Form Of Business

Advantages And Disadvantages Of Using Computer In Small Business Used Computers Small Business Business

Net Present Value Npv Vs Internal Rate Of Return Irr Acca Exam Investing Exam Net

What Is A Company Definition Characteristics Advantages Disadvantages

Advantages And Disadvantages Of Teamwork Teamwork Organizational Behavior Behavior

Comparison Chart Of Business Entities Startingyourbusiness Com Business Sole Proprietorship Business Structure

Comments

Post a Comment